Financial targets

In March 2024, HAKI Safety communicated financial targets for the Group. The targets are considered both realistic and compatible with responsible risk-taking.

Net sales of SEK 2,000 million by 2027

Target: Net sales are to amount to SEK 2,000 M by 2027. The net sales increase will be based on a combination of organic growth, organic growth projects and acquired growth.

Outcome 2024: SEK 1,050 million

Comments: Performance during the year was affected by the divestment of FAS Converting Machinery in January 2024 and by continued weak market growth during the first half of the year. In the third and fourth quarters, positive development was reported with organic growth and the acquisition of Semmco.

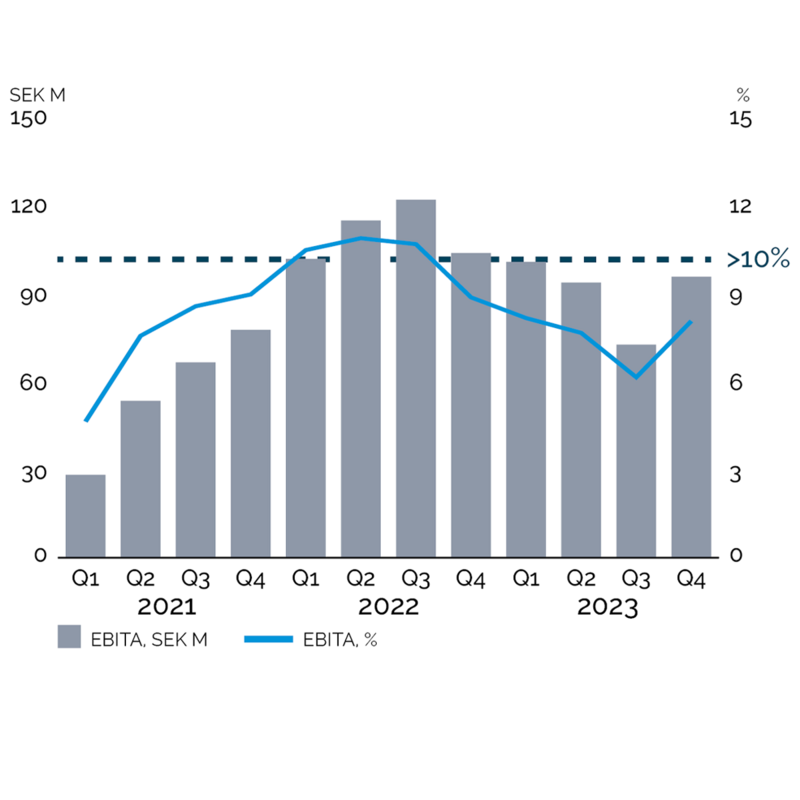

Adjusted EBITA margin >10%

Target: The adjusted EBITA margin is to amount to more than 10 percent. Adjusted EBITA margin is deemed to give a fair picture of the profitability of the underlying business as it excludes amortisation and write-downs of acquisition-related intangible assets and non-recurring items.

Outcome 2024: 7.3 %

Comments: Adjusted EBITA was SEK 77 million (95), corresponding to an adjusted EBITA margin of 7.3 percent (8.0), negatively affected by the market situation during the first half of the year but offset by the positive development of the gross margin.

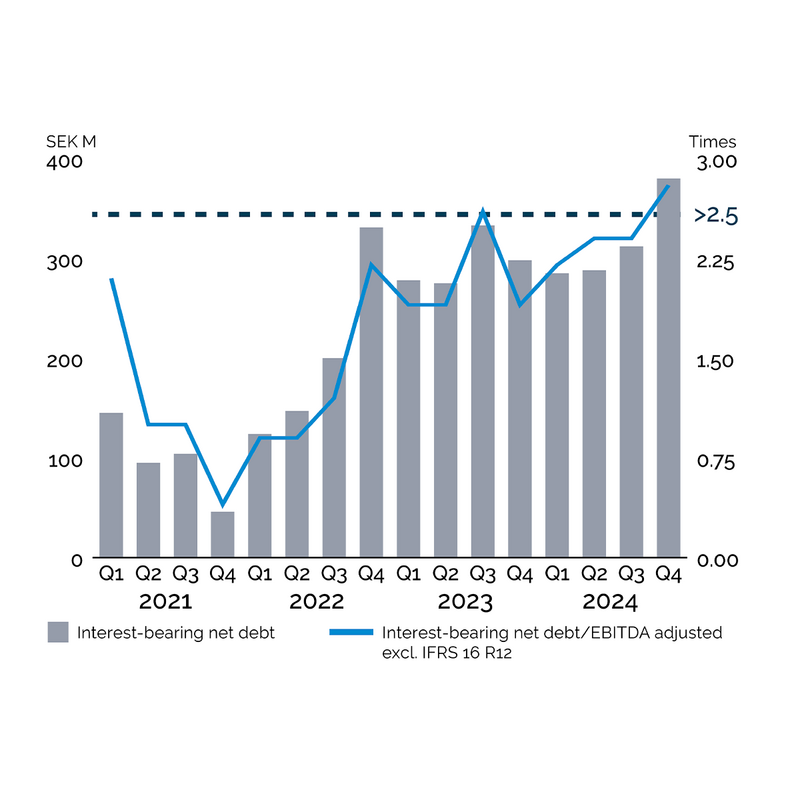

Financial net debt in relation to adjusted EBITDA <2.5

Target: Net financial debt divided by adjusted EBITDA is to be less than 2.5. The key figure shows the relation of net debt to adjusted EBITDA. The financial net debt refers to interest-bearing liabilities with deductions for cash and adjusted EBITDA as operating profit excluding depreciation, amortisation and write-downs and non-recurring items. The measures are measured excluding the effects of IFRS 16.

Outcome 2024: 2.8

Comments: The debt/equity ratio increased towards the end of the year owing to the acquisition of Semmco and was 2.8 (1.9). HAKI Safety Estimates that the ratio will decrease over time in connection with Semmco's profit generation and general continued profitability improvements.

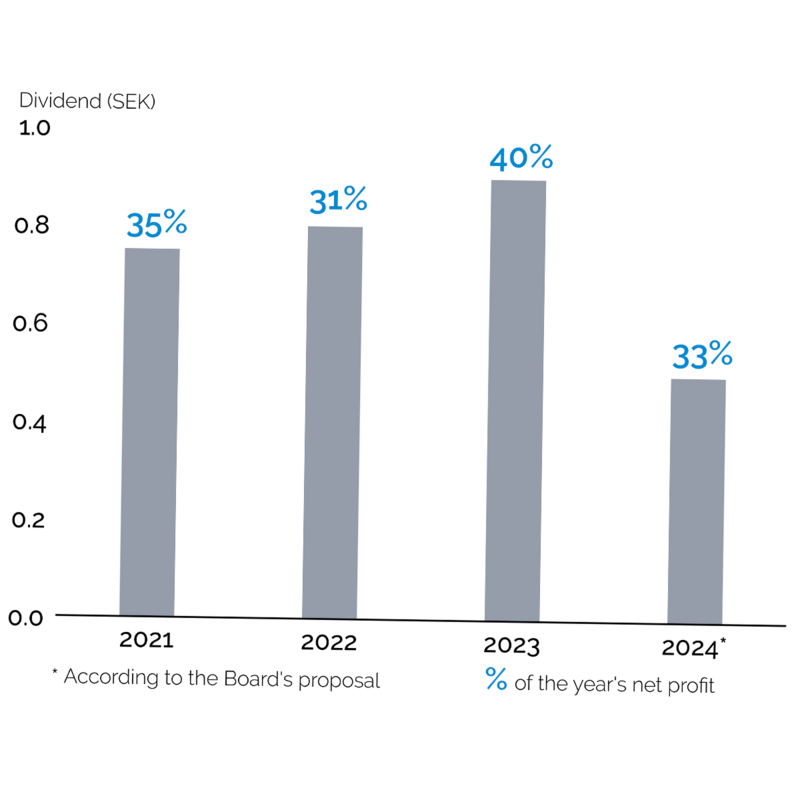

Dividend policy

Target: The dividend is to amount to 25-50 percent of the year's net profit. Proposals for dividends will consider the shareholders' expectation of a reasonable dividend yield and the business's need for financing.

Outcome 2024: 33%

Comments: The Board of Directors proposes to the 2025 Annual General Meeting a dividend of SEK 0.50 per share (0.90), taking ongoing acquisition activities into account. The dividend corresponds to 33 percent of

net profit for the year.